All Audit Methods

When you partner with Lowry & Associates for premium audit services, you get the experience of professional employees and independent contractors who understand your business and are committed to providing timely, accurate, and reliable audits.

Get in touch

We handle all types of insurance audits

Our broad collection of audit services, backed by our ability to customize services to your requirements, means we offer you a combination of physical, virtual, phone, and voluntary methods designed to specifically meet your underwriting strategy. Supported by a track record of accuracy, reliability, and timeliness, our services are backed by a USA -based and experienced quality assurance team, and an unmatched administrative and technical support staff.

All Audit Benefits

Physical Audits

Our physical audits include an in-person appointment that is scheduled and confirmed in advance and held with the audit contact, preferably at the insured’s premises. Having the appointment at the insured’s premises allows the auditor to tour the facility, see work areas, and correctly classify the operations. Physical audits require the review of original source records and includes a discussion with a principal or other audit contact regarding business operations and duties of employees. Upon completion, physical audits are reviewed and approved by our Quality Assurance Team before submitting to our carrier partners.

Physical Audit Benefits

Remote Audit Methods

(Virtual, Phone, Voluntary)

For many years, Lowry & Associates has handled and completed remote audits nationwide. Over the years we have refined, improved, and grown this process to now complete thousands of remote audits a month making us a leader in the industry. Our ability to provide customized, accurate, and comprehensive remote audit reports through employee and independent contract auditors provides a cost-effective option for carriers. Paired with our Quality Assurance Team, auditors generate a detailed report based on the completion method that fits carrier underwriting and budgetary needs.

Remote Audit Benefits

Virtual Audits

- Letters sent to the insured with list of documents needed and instructions to upload documents online at their convenience

- Source document copies are obtained, attached to a unique audit ID, and used for the audit

- Source documents may include: payroll reports, state/federal quarterly reports, profit and loss, and certificates of insurance

- Comprehensive audit report

- Billed hourly at reduced rate from physical audits

Phone Audits

- Letters and forms sent to the insured with instructions to complete the form online at their convenience

- Verbal contact made with a representative of the insured

- Multiple options to provide information, allowing more flexibility for the insured

- Flat rate pricing

- Essential audit report based on information provided by the insured

Voluntary Audits

- Letters and forms sent to the insured with instructions to complete the form online at their convenience

- Phone Audit Center (PAC) dedicated to complete audits using the information provided voluntarily by the insured.

- Audit information is analyzed and elevated to a phone audit if underwriting questions are discovered

- Unresponsive voluntary audits are converted to phone audits

- Flat rate pricing

- Basic audit report based on voluntary information provided by the insured

The following benefits are offered with Remote Audits:

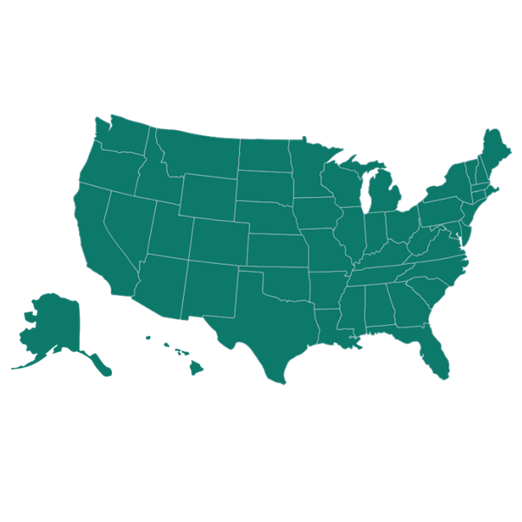

- Remote territory includes all 50 states

- Audit records are obtained and stored in a secure facility through one of our inventory management platforms

- Records can be accessed and examined by carriers and our audit team through our secure online portal in case of a dispute

- Online submission via a secure website allows convenience and flexibility to the insured to provide information using a unique username and password

- Fax, email, postal mail, and over-the-phone options are available to the insured, in addition to the online application

- Although sensitive information is never requested, the redaction team removes sensitive information contained on submitted forms or source documents

- No site visits required, allowing additional flexibility to the insured

The following benefits are offered with physical audits:

- Physical territory includes the 11 western states (AZ, CA, CO, ID, MT, NM, NV, OR, UT, WA, and WY)

- In-person site visit for examination of source documents that remain on-site

- If unsual circumstances prevent a physical visit, we have the ability to convert to a virtual method as requested by the insurance carrier or policyholder

- Professional, in-person representation of insurance carrier

- Location tour per carrier requirement

- Audits tracked by an Area Inventory Specialists (AIS)

- Comprehensive audit reports

- Billed hourly

- Audits assigned by territory and auditor capacity

The following benefits are offered with all audit methods (physical, virtual, phone, and voluntary):

- Policy Types: General Liability, Workers’ Compensation, Garage, Auto, Composite

- Customized call process or an in-person appointment to gather information

- Contact carrier agent as needed to facilitate the audit process

- Customized letters, forms, and process flow

- Average 60-day time service

- Policyholder support provided by Customer Service Center (8:00 am – 6:00 pm MT)

- Each carrier assigned a designated Carrier Specialist (CS)

- Technical support provided to auditors by Field Support Mentors (FSM)

- Audits reviewed by Quality Assurance Team

- Audit reports integrated with premier audit platforms

- Able to feed audits into carrier inventory management programs