How do I complete the “Adjustments” section on my audit form?

Step 1: Determine your Audit Period.

Your “Audit Period” is not necessarily the same as the Policy Period. Your Policy Period can’t change, but you have some leeway with what you use as your Audit Period. In most states, your Audit Period start and end dates need to be within 15 days of your Policy Period start and end dates. In California, it needs to be within 30 days of your Policy Period start and end dates. For simplicity, we recommend that you round your Policy Period to the beginning of a month for your Audit Period. For example, if your Policy Period is 11/17/2014 – 11/17/2015, we recommend that you use 12/01/2014 – 12/01/2015 as your Audit Period.

If your Policy Period is within 15 days of the beginning of a calendar year quarter, (Jan 1, Apr 1, Jul 1, Oct 1), we recommend that you round to the beginning of the quarter for your Audit Period. This simplifies things in the next step. For example, if your Policy Period is 06/15/2014 – 06/15/2015, it’s better to use 07/01/2013 – 07/01/2014 as your Audit Period than 06/01/2014 – 06/01/2015, even though they both are within 15 days, because 07/01/2014 – 07/01/2015 starts and ends with a calendar year quarter.

If your Policy Period is not for a full 12 months (it doesn’t start and end on the same day of the year), you will not be able to round your Policy Period to get your AuditPeriod. Use the exact policy period as your AuditPeriod.

Step 2: Select appropriate payroll reports as needed

Review steps 3-5 below to determine which date ranges that you will need payroll reports for. When getting a payroll report for your Audit Period, make sure not to include any wages paid on the last date of the Audit Period. This means that if your Audit Period is 1/1/15 to 1/1/16, you would get a payroll report showing all checks paid from 1/1/15 to 12/31/15. The final date is not supposed to be included. Policy Periods are defined as 12:01 AM on first date to 12:01 AM on the second date. Audit Periods are defined the same way. But in practice, because payroll reports are not pulled by minute, we use reports that contain full days of payroll. The Audit Period of 1/1/15 to 1/1/16 really means payroll reports for the actual date range of 1/1/15 to 12/31/15.

Step 3: Determine if you need to provide adjustments.

If your Audit Period does start and ends on Jan 1, Apr 1, Jul 1, or Oct 1, you will not need to provide adjustments because the total from your four quarterly reports should be the same as the total payroll from the audit period. You can skip the adjustments section and move on to the next section of your forms.

If your Audit Period does not start on Jan 1, Apr 1, Jul 1, or Oct 1, you will need to complete the “Adjustments” section. Go on to Step 3.

If your Audit Period is not a full 12 months, you will need to complete the “Adjustments” section, providing separate adjustments for before the first quarter listed and after the last quarter listed. Go on to Step 4.

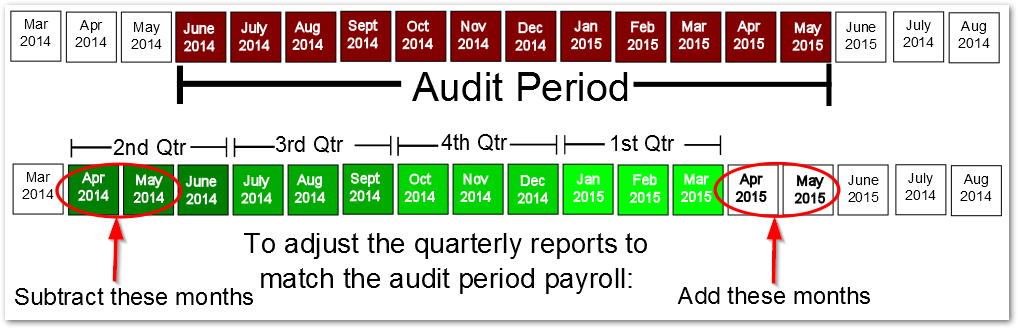

Step 4: Determine what wages need to be subtracted.

Scenario 1: If the first day of your quarterly reports is before the first day of your Audit Period:

The days from the beginning of the quarterly reports to the beginning of your Audit Period are included in the quarterly reports, but not in the Audit Period payroll total. Therefore, we need to subtract that amount from the quarterly reports.

Example: The 3rd and 4th quarters from 2014 are used. The 1st and 2nd quarters from 2015 are used. Therefore, the quarterly reports start on 07/01/2014 and end 06/30/2015. Suppose the Audit Period is from 08/01/2014 – 08/01/2015. Therefore, the wages from the beginning of the quarterly reports (07/01/2014) and the beginning of the Audit Period (08/01/2014) are not included in the Audit Period payroll, but are included in the quarterly reports. To get the quarterly report total to match the Audit Period total, we need to subtract any wages paid from 07/01/2014 to 07/31/2014.

Scenario 2: If the first day of your quarterly reports is after the first day of your audit period:

The days from the end of the Audit Period to the end of your quarterly reports are included in the quarterly reports, but not in the Audit Period payroll total. Therefore, we need to subtract that amount from the quarterly reports to get the quarterly report total to match the Audit Period total.

Example: The 3rd and 4th quarters from 2014 are used. The 1st and 2nd quarters from 2015 are used. Therefore, the quarterly reports start on 07/01/2014 and end 06/30/2015. Suppose the Audit Period is from 06/01/2014 – 06/01/2015. Therefore, the wages from the end of the Audit Period (06/01/2015) and the end of the quarterly reports (07/01/2015) are not included in the Audit Period payroll, but are included in the quarterly reports. To get the quarterly report total to match the Audit Period total, we need to subtract any wages paid from 06/01/2015 to 06/30/2015.

Step 5: Determine which wages need to be added

Scenario 1: If the first day of your quarterly reports is before the first day of your audit period:

The days from the end of the quarterly reports to the end of your Audit Period are included in the Audit Period total, but not in the quarterly report total. Therefore, we need to add that amount to the quarterly reports to get the quarterly report total to match the payroll total.

Example: The 3rd and 4th quarters from 2014 are used. The 1st and 2nd quarters from 2015 are used. Therefore, the quarterly reports start on 07/01/2014 and end 06/30/2015. Suppose the Audit Period is from 08/01/2014 – 08/01/2015. Therefore, the wages from the end of the quarterly reports (07/01/2015) and the end of the Audit Period (08/01/2015) are included in the Audit Period payroll, but are not included in the quarterly reports. To get the quarterly report total to match the Audit Period total, we need to add any wages paid from 07/01/2015 to 07/31/2015.

Scenario 2: If the first day of your quarterly reports is after the first day of your audit period:

The days from the beginning of the Audit Period to the beginning of your quarterly reports are included in the Audit Period total, but not in the quarterly report total. Therefore, we need to add that amount to the quarterly reports to get the quarterly report total to match the Audit Period total.

Example: The 3rd and 4th quarters from 2014 are used. The 1st and 2nd quarters from 2015 are used. Therefore, the quarterly reports start on 07/01/2014 and end 06/30/2015. Suppose the Audit Period is from 06/01/2014 – 06/01/2015. Therefore, the wages from the beginning of the Audit Period (06/01/2014) and the beginning of the quarterly reports (07/01/2014) are not included in the Audit Period payroll, but are included in the quarterly reports. To get the quarterly report total to match the Audit Period total, we need to add any wages paid from 06/01/2014 to 06/30/2014.